Wil Schroter

We're going to update our financial statements using a simple accounting process that requires zero professional accounting experience or accounting software — it's just our income statement spreadsheet.

Click here to download our template to follow along.

The next step after we've captured all of our financial transactions in our spreadsheet accounting system will be to process each of the financial records in order. Earlier we began recording transactions from our bank accounts and credit card statements, so now we'll drop them into the Tabs we set aside for business expenses and revenue.

What Tabs will we Populate?

We've broken our spreadsheet accounting system into a handful of useful tabs to populate.

Here's the quick list, then we'll go over how to drop your financial data into each one:

Overview - A summary of all inputs, as well as Net Income calculation.

Revenue - All products or services sold.

COGS - Cost of Goods sold (if any).

Marketing - Isolating marketing expenses for accurate accounting

Staffing - All salaries the business regularly pays, including the startup owners.

Misc Expenses - Keeping track of all expenses not in other categories

Most of this should be reflected in our day-to-day operations, for example, our accounts payable pulled out of our bank account or (more likely!) on our credit card. This is also the same information we'll use for our tax returns, so it's just a good accounting system overall.

Overview Tab

The overview tab is going to automatically calculate all the activity from the other tabs. We should never type anything directly into this tab as it doesn’t contain any input boxes.

Please note that changes we make to the other tabs may “break” the calculations in the overview tab so let’s make sure to double-check our calculations as we modify the template.

On the other hand, this is the tab where all the magic happens, so as we populate each of the other tabs we’re going to start to see our entire financial picture come into focus.

Revenue Tab

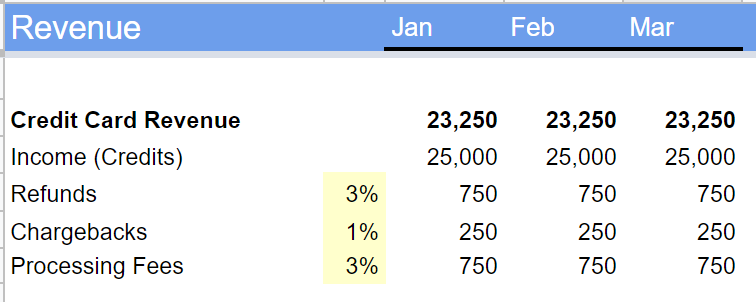

The revenue section will have its own tab in our profit and loss statement. In the revenue tab there will be areas for individual product revenue, refunds, and chargebacks.

We may want to separate the revenue differently, such as per product, which is fine. We’re only separating it by source for the time being so that we make sure we have a consistent way of mapping all of our monthly sources to the income statement. Over time as we master this process, we can adjust it to suit our needs.

Credit Card Revenue

In the revenue tab, we will keep separate sections for each product. For example, if our business has three products we will have line items for Product 1 revenue, refunds, and chargebacks, and the same for Product 2 and Product 3.

These designations are important because we want to see how each individual product is performing and have granular information in understanding the overall picture.

Our payment processor will provide the source data for each individual product at month’s end. For instance, if Product 1 has $100,000 of revenue in October, $10,000 in refunds, and $2,000 in chargebacks we will add $100,000 to the Product 1 revenue row, -$10,000 to the refunds row (contra-revenue), and -$2,000 to the chargebacks row (contra-revenue).

This will result in Product 1 showing $88,000 in net top-line revenue for the month. The amount of $88,000 will filter into total top-line revenue, along with the net revenue of the other products. Note, we will repeat the above process for all products.

Invoices/Checks

Some clients may not want or be able to pay us via credit card so it is crucial to properly track and record. If we send a client an invoice for $15,000 and they mail us a check for the amount - when we receive that check we need to record the $15,000 of revenue in our income statement. This would go in the revenue tab under checks received.

Likewise, if a client requests a refund and we send them a check for that amount - we would record the refund under the checks received section of the revenue tab. Sometimes during the chaos of the month, these transactions can be lost in the shuffle, so we need to make special note of them!

Cash

It may be rare in this day in age, but a customer may pay with cash. All cash transactions can be added to the revenue tab under “other sources.” If a client hands us $50 physical cash for a service — we can record that transaction there. Conversely, if we need to refund a client $100 with physical cash for a service - we can subtract -100 from the other sources section as contra revenue.

COGS (Cost of Goods Sold) Tab

As stated in the COGS section of forecasting - COGS entail direct and variable costs of physical goods. At the end of the month, we will want to ascertain these final values and assign them to the appropriate sections of the COGS tab.

These final costs will appear in month-end bank and credit card statements.

For example, if our monthly rent was $1,000 for a production facility we would record this cost under variable costs. Likewise, if we sell 100 units and our direct cost is $180 per unit then under direct costs we would record 100 and $180 — which would generate total direct unit costs of $18,000.

Staffing Tab

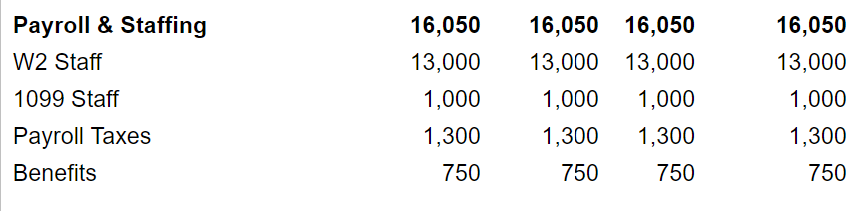

One of the more dynamic costs of our business will be staffing costs. Staffing costs includes: the gross pay to the employee – for instance, $4,000/month if the employee is salaried at $48,000 per year.

Also, don't forget, our silent partner (the government) gets their cut on the federal, state, and local level through payroll taxes. Finally, we want to be mindful of benefits cost. With all that being said, it is important to note the cost of an employee goes beyond the stated salary and can be inflated by a number of additional costs.

W2 Staff

Each individual employee will appear in our payroll processor’s monthly report. From this report, we can pull the stated final amount for each individual and add it to the staffing tab for their specific name or role.

For example, the CEO is paid a gross salary of $5,000 per month would be added from this report. Giving each individual their own line item allows us to see that first and foremost we compensated everyone correctly - it also allows us to better track costs.

1099 Staff

Each 1099 we contract during the month will also show up in our payroll processor’s monthly report. The difference with these employees is that we will not have benefits or payroll tax costs attributed to them.

It is beneficial to input each 1099 and the amount paid to better track their final costs and to elucidate where we are spending. Hence, the web designer for $1,000 per month would have their own line item in the staffing tab of the income statement.

Payroll Taxes

This part is important, and we need to make sure we are accounting for payroll taxes! As stated above, the government is our silent partner. However, the government requires being paid regardless of how the business is doing. We want to keep the government happy and avoid any payroll tax penalties.

Luckily, payroll administrators like Intuit, Gusto, and others pay the government for us and make note of these payments in our month-end payroll reports. This most likely will come under a field called “Employer Taxes.”

Typically, employer taxes come out to 7% to 8% of gross payroll expense. That is, if our monthly payroll expense is $25,000 for 5 employees, then we can expect to pay approximately $1,750 to $2,000 in payroll taxes. This payment will be its own monthly line item in our staffing tab.

Benefits

Health benefits are worthy of a course within itself, but long story short, we need to track and record this cost if we offer it to our employees. Our payroll processor will integrate our health benefits cost into our payroll report for us.

For example, if we use a provider like United Healthcare, the month-end payroll report will include a section for employer and employee contributions to benefits. Employer contributions will be our expense. We need to take total employer contributions and input this monthly expense into the benefits section of the staffing tab.

Miscellaneous Expenses Tab

Perhaps one of the more overlooked, but still an extremely important part of expenditure recognition is the miscellaneous section. In our profit and loss statement, our miscellaneous tab will include the following sections: site support, office support, card processing fees, SaaS, and miscellaneous.

These expenditures will be sourced from our month-end credit card and bank statements. It will be helpful to export these files and dump the data into a “To Be Determined” tab in the profit and loss statement. Basically, a place where we can pool all the monthly expenditures and sort them into the appropriate miscellaneous tab sections.

Office Services

Our business will have monthly office expenditures even if we operate from home! This could include things like a lease, insurance, coffee for the staff, cleaning services, and office supplies, among others.

SaaS Vendors

Our monthly software subscriptions are important to track because they can add up quickly and represent the tools needed to operate our business. For example, this section could include things like a LinkedIn subscription, Microsoft Office tools, payroll processor service payments, or even something as simple as an office Spotify account.

Miscellaneous

This will include one-off expenditures, such as an employee using the corporate credit card for lunch, a one-time update to the office (i.e., new wall decorations), a one-time UPS mailing charge, an Amazon purchase, and anything else that may arise.

It is important to keep this section for costs that will most likely arise once or unpredictably in the future. Any new costs that will be periodical should find their homes in the above sections.

Getting to the Finish Line

Hey look — we just did our startup company's accounting, and we didn't even realize it!

We went from grabbing our bank statement to copy/pasting a few (hopefully) accurate records to updating a single accounting period like a champ!

What's Next?

Now that we've got all of our financial transactions inputted, we're going to begin the more important step of analyzing the results and making some important business decisions about what we learned.

As the numbers become more obvious, it will also help us forecast the business, which will be especially helpful if we're going to raise capital from professional investors at any point. Even if we don't (or hopefully don't need to!) we'll still need to understand what all of this means.

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.

Already a member? Login

Start a Membership to join the discussion.

Already a member? Login

Great blog.