The Startups Team

Welcome to Phase Three of a four-part Splitting Equity Series. If you missed it, start your journey here: Introduction - Early Startup Equity — Getting it Right before continuing on if you haven’t already, and go in order from there.

Phase One - Startup Equity - Avoiding Early Mistakes

Phase Two - How Startup Equity Works

Phase Three - Part 1 - How to Split Equity

Part 2 - Splitting Equity Today

Part 3 - Splitting Equity in the Future

Part 4 - Calculating Startup Equity Splits + FAQ (←YOU ARE HERE 😀)

Phase Four - Equity Management

Let's continue!

At this point, we have all we need to calculate our equity splits. It’s showtime, baby! All of the different agreements we’ve made from this point on are just a formula to calculate an outcome. Ideally, there isn’t much to consider other than making sure we got our math right.

Let’s do a quick review of the key elements that we’ll use to create a fair split:

Contributions are made at market values

We translate each co-founder's respective contributions into a fair market value, using a multiplier of 4x for cash and 2x for non-cash (like sweat equity) versus just doing "equal equity splits."

We Split Equity over a 3-Year Window

We determine how many years we will use to calculate the total of each founder's contribution, allowing us to see if our contributions and co-founder relationship will change over time.

Propose our Year 1 Initial Capital Contributions

Each co-founder proposes how much they intend to contribute in Year 1 (intellectual property, sweat equity, cash) which serves as a guideline as to how much equity they would potentially earn, but also a commitment to the rest of the team before dividing equity.

(Optional) Setup a Founder Stock Pool

In the event we want to protect against too much individual dilution in our co-founder equity split, we can agree that only a % of the total company ownership will get re-distributed over time. This can be applied toward a vesting schedule that we all agree on.

Yearly Contribution Reviews

Each calendar year on the anniversary of our agreement we each review what our intended contribution was versus our actual contribution and use our startup equity calculator to award ownership percentages.

Yearly New Contribution Proposals

Each year the co-founders will propose their future contributions for the year, assuming how they are sharing company ownership may change year to year as is typical in the early stages.

After 3 Years, We have a Fair Equity Split

At the end of our 3-Year term (or whatever term we decide) the co-founders divide the company's ownership amongst the founders based on actual contributions.

Now that we know the inputs, let’s figure out how to get a final calculation on our equity splits for our multiple founders.

The Total Contribution Value is the Valuation

There’s a meaningful difference in how we value our startup company as Founders versus how we will value it for outside contributors like potential investors or early employees. At inception, the value of our contributions is relative to everyone else’s contributions. That’s a super important point so let’s make sure it’s not lost.

If the total value of my contribution to our startup company is $100 and the total value of your contribution to the startup company is $150, then the total valuation of the company is $250 - for this exercise.

This is easy to misunderstand because we tend to think of “valuations” as the value of the company itself — and that’s generally true. In this case, what we’re really talking about is splitting ownership based on the relative value of each of our contributions.

If you contribute $150 (which is more than my $100) then you get more of the equity, but by way of that, the whole company is also worth more ($250 vs. $100 with just my contribution).

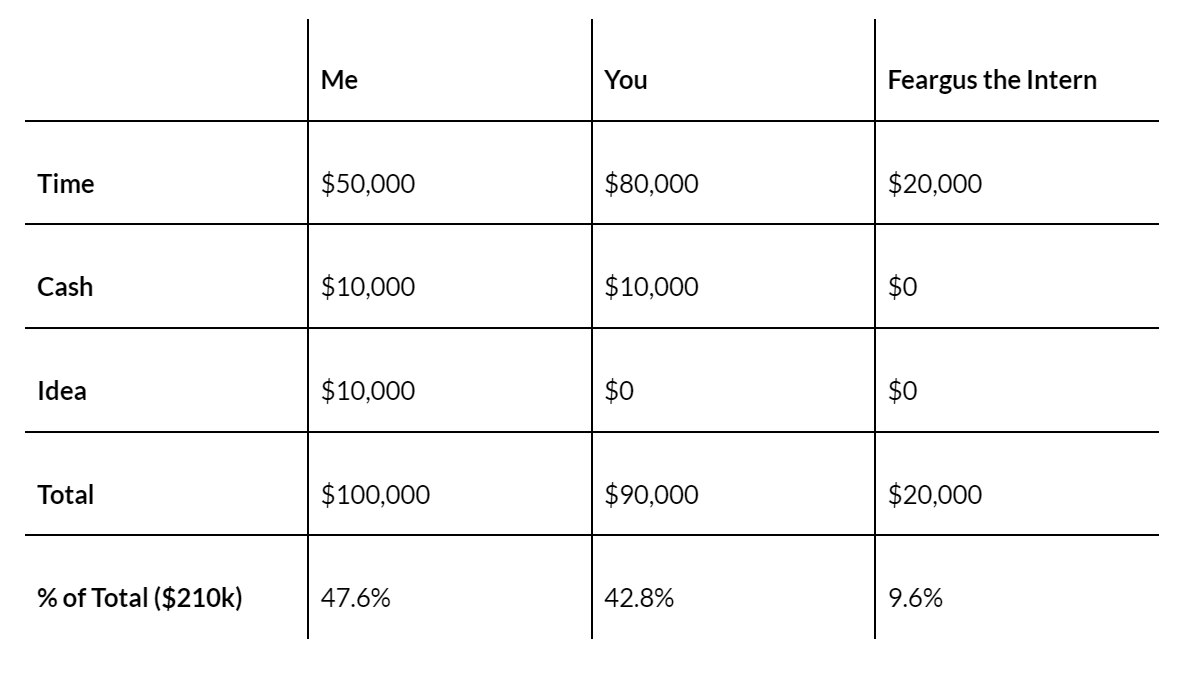

Here’s what our proposed total contribution would look like in Year 1:

At this point, we each contributed a total of $210,000 of value in Year 1 and therefore we’re splitting our value “pro rata” amongst ourselves. We can’t earn any more value than we contribute, and that value is proportionate to everyone else’s contribution.

But wait! There’s more!

As we recall, however, Year 1 is just part of the equation. We can start with this split, but recognize that it will change over time when we revisit in Year 2 and beyond.

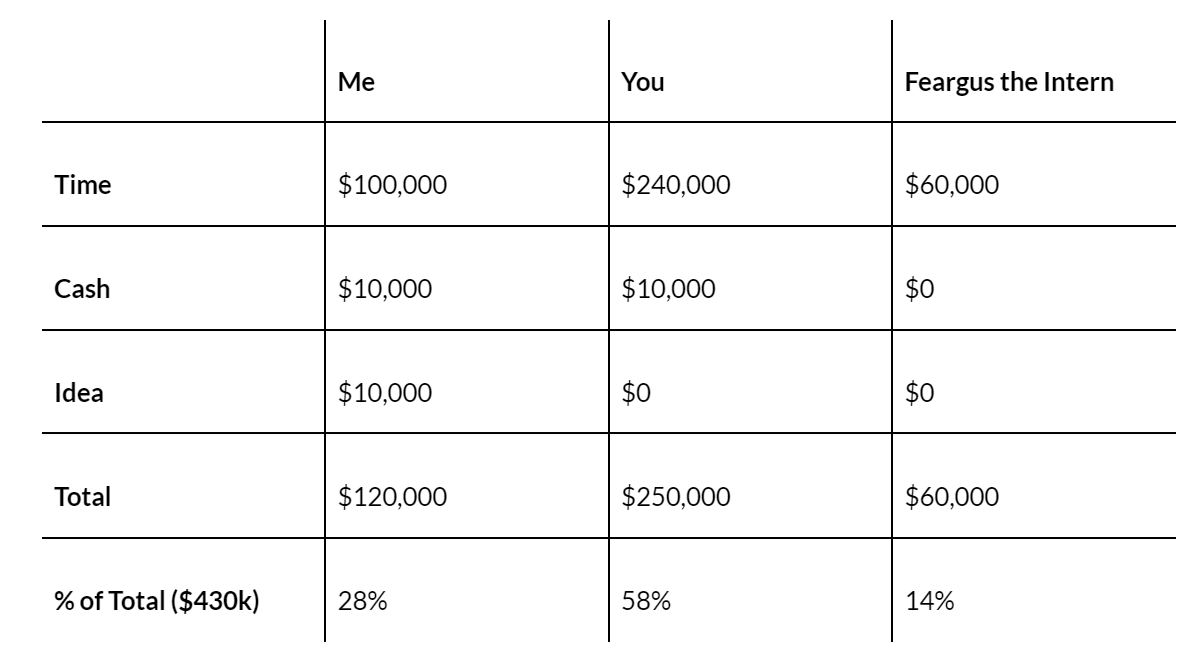

If we go forward in time we can envision what our founder equity splits would look like after 3 years:

Now we can see what having a 3-year window really does.

If we had just used a single year I would have had 47.6% of the company versus 28% which is how much I earned over an extended period of time. Good Ol’ Feargus stuck it out (and apparently never earned more than an intern’s wages) but still wound up with 50% more than he would have had in Year 1.

You were able to stay on board full time (versus me going part time) and by way of that, your contribution compounded over 3 years to make you majority shareholder. Nice work!

The effect of this is how the valuation of the company was driven by the relative contributions of each member. As you contributed more, the value of your contribution relative to ours increased, and therefore so did your stock.

How Actual Shares are Distributed

Now that we understand how our contributions will be valued, let’s discuss how our shares will be distributed. Most of our contributions will take time to calculate, but we need to make actual legal share distributions even on Day 1.

Step 1: Issue Initial Shares

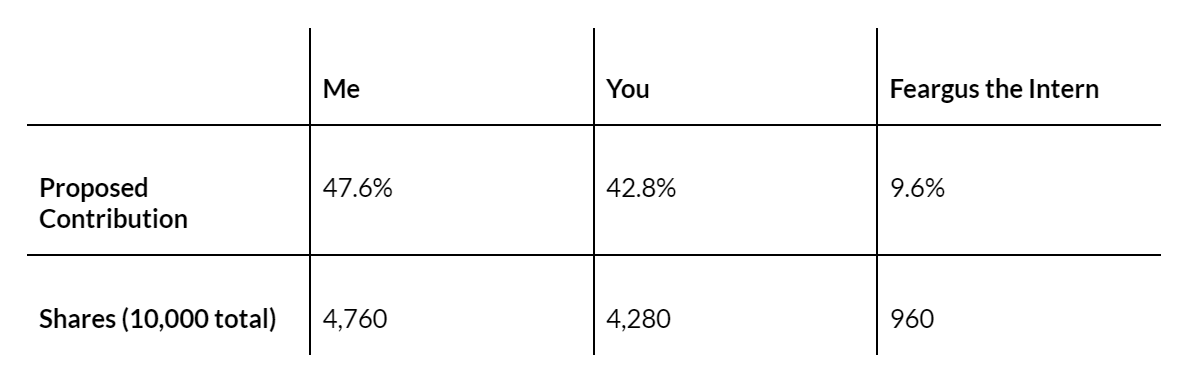

The number of shares we issue initially should be split in proportion to our initial Year 1 proposals. This isn’t a final distribution by any means, but it at least sets the tone for how shares will be issued. Just as importantly, it forces the conversation about contributions versus a simple “let’s just split it 50/50” conversation.

If the company was formed with 10,000 shares, we would split those shares based on our proposed contributions for Year 1. In our example, I would receive 47.6% of the shares (4,760), you would receive 42.8% (4,280) and Feargus would get 9.6% (960).

Initial Shares based on Proposed Year 1 Contributions

Note that the percentage we each own will change dramatically as we issue more shares, so these amounts are only relevant until we hit the next share adjustment of our founder equity splits.

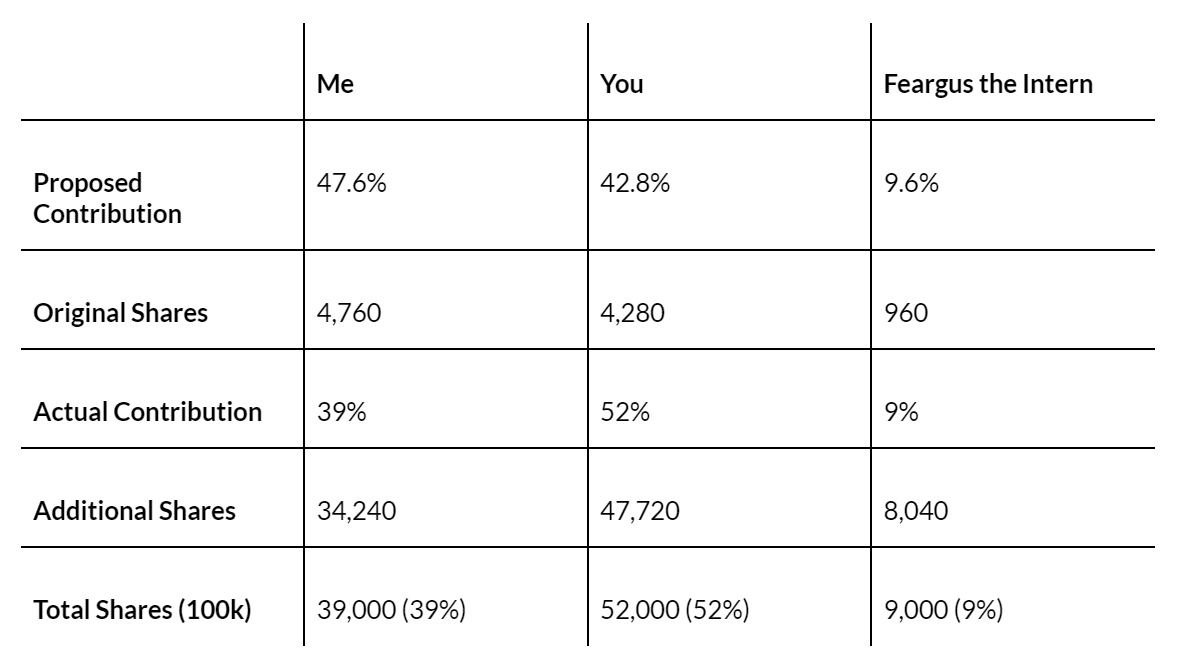

Step 2: Issue New Shares

After Year 1 (and each milestone year after) we would issue additional shares (the 10,000 share total would increase) based on the changes that have occurred in the company. Each time we issue additional shares we dilute the relative percentage of existing shareholders.

For example, if we the 3 of us held 10,000 shares, and we issued 90,000 new shares that we gave to a new investor, there would be 100,000 shares in the company. We would collectively own 10% of the company (10,000 shares) and the new investor would own 90% (90,000 shares).

Issuing new shares allows us to change the relative ownership amounts without “taking shares back” per se. This is a common practice when taking on investors as it allows the existing members to hold onto their units while issuing new units for the incoming investor. Companies can issue new shares far more easily than they can claw back existing shares.

Shares Issued at the end of Year 1

What we just did was issue 90,000 new shares on top of the 10,000 shares we initially issued - for a total of 100,000 shares. Now, all we have to do is allocate the 90,000 shares according to who needs more shares to reach their percentage contribution.

In my case, I had intended to contribute 47.6% of the value but only wound up with 39% of the value. My original shares stay the same (4,760) and we just issue me a smaller percentage of the newly issued shares to make the adjustment.

Step 3: Repeat Each Year

The formula for updating our shares remains the same each year. We can issue any number of new shares we want (we used 90,000 + 10,000 for easy math). All that matters is when we total up our number of individual shares they represent our updated percentage ownership derived from our contribution.

As noted earlier, we may in fact issue new shares for all kinds of reasons, including taking on investors or just making more room for employees and partners. These adjustments should always be reviewed by an attorney to make sure we’re covering the consents amongst the members properly, but this is standard stuff.

Founder Equity Split FAQ

There are a lot of important factors that go into setting up vesting schedules, an option pool, or anything regarding equity shares for a startup company. Let's take a look at the questions we get asked most consistently.

Investors get to invest once and get paid forever — why can’t Founders do that?

Yes, investors get to invest once and get their stock all in one shot. But there are two considerations here. Founders make the decision to take investments that will only be used once. They have to weigh that trade-off in creating dormant members of the Cap Table. Therefore, they are granting that right in a deliberate manner.

However, Founders also enjoy the benefit of getting paid their own equity relative to their co-Founders, not relative to their actual investment. We may have only invested $100,000 of our time and capital but wind up with 40% of the entire company. Yes, we have to actually work there while investors get to enjoy the perks forever, but our payout was exponentially more based on our actual market investment. If we talk to enough Founders and investors, they both feel they are getting equally screwed, so…

What if we already split up the equity? Can we retrofit to re-allocate based on contributions?

We could. The goal would be to put a percentage of our equity back into a Founder Stock Pool (we discussed this earlier) to be re-allocated based on actual contributions or milestones. That said, getting everyone to agree to give back equity that they may not have earned is like getting Charlton Heston to give up his rifle from his “cold, dead hands.” But yes, it’s 100% possible.

Is this how every startup splits equity? If not, why not?

Most equity split discussions happen amongst members who have never split a company before and tend to do little research into how it’s done. This is where we tend to see one-time splits that are “50/50” with very little regard to market value contributions or contributions made over time. There’s likely an inordinate amount of major companies that have been founded this way, but we’ll never know because these discussions happen behind closed doors. That said, there’s really no benefit to avoiding this process for anyone since it’s not that hard to implement and it provides a mechanism to distribute equity fairly.

What happens if new members or co-founders are added over time? How do we revisit this?

Typically, members added after formation get a smaller stake in the company than those who were there at the formation (which isn’t necessarily “fair”, it’s just typical). There are some ways in which we can modify this model a bit but in most cases, we’re likely going to offer a target award amount based on a specific contribution and then track that reward based on the contribution over a few years.

Are there any more detailed formulas for splitting equity?

Yes! If you want a more regimented format for how to divide and track equity, we’d highly recommend Mike Moyer’s fantastic Slicing Pie method (slicingpie.com). Mike’s Slicing Pie method is a combination of books and software that not only create more granular methods for tracking contributions but also include systems and software to do it. Many of the fundamentals of this course are mirrored in the principles that Mike employs so if you like this approach to splitting equity, you’ll really love what Mike has to offer.

Summary on Startup Equity Splits

Once we understand the basic functions of how to use actual contributions to develop a fair split of equity, the conversation becomes a lot easier. It’s difficult to refute “My contribution drives my equity stake” since that really is the most direct reflection of ownership.

That said, even if we don’t follow these formulas exactly to the letter, and we do go and make a one-time split, the benefit of understanding these challenges is still there. Even if we decide that “We don’t want to adjust equity year-over-year” we can still use the contribution calculators and exercise of “What do we really intend to contribute?” as a great way to have a discussion beyond “let’s just split 50/50.”

No matter how we proceed, we shouldn’t go this alone. All of these approaches should be taken with at least a strong look from a qualified lawyer to make sure we’re not missing any major points. The small amount of money we’ll spend to get a simple review will pale in comparison to what it would take to unwind an uneducated “guess” on how this works!

Now that we understand how to set up and distribute our equity, let’s talk about what happens over time when we need to manage it and account for the many changes a startup inevitably faces!

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.