The Startups Team

Continuing in Phase Three of a four-part Funding Series:

Phase One - Structuring a Fundraise

Phase Two - Investor Selection

Phase Three - The Pitch

Part 1 - Anatomy of a Pitch

Part 2 - Market Size

Part 3 - Revenue Model

Part 4 - Operating Model

Part 5 - Customer Definition

Part 6 - Customer Acquisition

Part 7 - Funding

Part 8 - Key Pitch Assets ( ←YOU ARE HERE 😀)

Part 9 - Traction

Phase Four - Investor Outreach

Let's dive in!

Our investor pitch deck is just one of a handful of assets we need to have prepared for potential investors. A compelling startup pitch deck is just part of the package — if we're going to raise money and impress investors we'll need to prepare everything from our elevator pitch to our financial projections to a comprehensive business model.

What do Investors Expect?

At the very least potential investors will expect startup pitch decks to incorporate things like our financial projections, competitive landscape, and marketing plan, but they often request these in different form factors depending on the type of investor.

For example, investor pitch decks for venture capital investors (think: the Airbnb pitch deck) can probably exist on a dozen slides, but if we've got a real estate pitch presentation, we're certainly going to be asked for detailed five-year financial projections and a more comprehensive business plan to attract investors.

What are the 6 Key Assets for an Investor Pitch?

First we'll look at 6 assets a successful business will use to raise funds and then go a bit deeper into some pitch deck examples and some key points that will help you raise money from prospective investors.

Elevator Pitch

This is a well-crafted 2-3 sentence pitch of your business model that quickly conveys the Problem, Solution and Market Size. This is used alongside your startup pitch deck when raising money and is what's often sent ahead of our own pitch deck for prospective investors to quickly understand your business idea.

Pitch Deck

Following a familiar pitch deck template, you'll present 10-12 slides that highlight the key points of your business model. The best pitch decks are short and sweet, replacing long narratives with quick bullet points that cover everything from sales channels to the market opportunity to the exit plan for prospective investors.

Executive Summary

This is a more narrative version of your pitch deck or just the key information of your business plan. Whereas pitch deck examples may show more visual elements of key metrics or early traction, the Executive Summary condenses this into just 2 pages with a few sentences, but still covers all the elements of your own pitch deck.

Business Plan

A business plan is your own presentation of the pitch deck in specific detail — the long-form narrative. Whereas something like the Facebook pitch deck might be 12 slides with a few key points on each, the business plan would take those same slides and expound on each detail, such as the target market or perhaps a very detailed profit and loss statement.

Financial Documents

These often run alongside a startup pitch deck or business plan for the investor pitch. Investors are going to want a detailed financial model that shows total revenue, recurring revenue (if any), gross margins, and marketing expenses to name a few. When raising capital we want to show the business potential numerically and how that maps back to an exit strategy later on.

Company Collateral

The same company collateral that we prepare for prospective customers is also a great resource for prospective investors as it helps spark interest in our startup by showing some early traction in our development. This will manifest in everything from our Web site to our pitch deck to our overall brand identity.

Let's take a deep dive into each investor pitch asset and explain how they collectively help you when raising money.

Elevator Pitch

The elevator pitch is a short, consistent summary of your business model, which is then summarized in a great pitch deck. It can be hard to boil your business down into just a few sentences, but often that is all the time you have.

The term “elevator pitch” comes from the idea of a chance meeting with an investor in an elevator, where we only have the length of an elevator ride to deliver our sales pitch.

Short Pitches are Hard Work

It may surprise you the amount of work you and your co-founder might put into just a few sentences. When you look at something like the Intercom pitch deck or the Mattermark pitch deck the elevator pitch they've built around them is incredibly simple — just a couple of sentences — but it's the polar opposite!

Condensing our thoughts into just a couple of sentences takes a tremendous amount of refinement. That's because a good Elevator Pitch conveys a few things quickly — the Problem you solve, the Solution you provide, and the Target Market you do it for.

Examples of Great Elevator Pitches

"Netflix allows anyone to easily rent movies from their home computer"

“Under Armour provides apparel to keep athletes cool, dry, and light when they need it most.”

These pitches impress investors not because of the scope of what they have become, but for the simplicity of how well investors understand them. We don't get points for the complexity of our elevator pitch!

The Email Pitch

In today's world, you're likely going to pitch far more investors through an initial email than you will in person. A great Email Pitch won't necessarily get you a meeting but a bad one will definitely prevent one. Therefore creating the perfect Email Pitch is essential.

A Simple Email and Pitch Deck Template

Here's a simple email template you can follow along with your attacked investor pitch deck to be confident you're sending the right information.

Subject Line — "Give a compelling reason to open the email"

Personal Connection — "Establish a common connection"

Elevator Pitch — "Add your pitch in 2 sentences or less"

Traction — "Demonstrate the startup is gaining steam quickly"

Team — "Highlight the experience or focus area of the team"

Social Proof — "Cite people or sources who can vouch for the startup"

The Ask — "Specify how much you're raising"

Get a Meeting, Don't "Close the Deal"

A common mistake for first-time early-stage Founders is trying to craft an email pitch that "closes the deal" with investors. This isn't the time or place for that. The best emails with the best pitch decks simply pique the investor's interest with some fast facts and a vision of projected growth.

Our target audience (investors) just want to know there is a market opportunity here worth pursuing and that we might have some huge advantage worth investing in — but they need to take the pitch first! Just ask for the meeting, no more.

Pitch Deck

Our pitch deck is the heart and soul of our plan to attract investors. We use a consistent pitch deck template every time we want to encapsulate and communicate our business idea to investors.

Investor Pitch Deck

While a business plan tends to be a long narrative of the business intended for one person to read on their own (which rarely happens — but more on that later), the pitch deck is what you’ll use to present your concept to an investor to review and later for you to present in person.

Pro Tip from Venture Capital Legend Fred Wilson

Fred Wilson advises making an effort to condense your pitch deck into just six killer slides.

“Killer slides are not slides with a dozen bullets each. They are six powerful points that combine to tell the meat of the story. So when you sit down and build your pitch deck, think of six slides that will inspire and leave something for the imagination. The best part of six slides is that you will get through them in time to have a real substantive conversation face to face about your business. Imagine that.”

Fred Wilson, Principal / Union Square Ventures

The Perfect Pitch Deck Template

When preparing your pitch deck, keep in mind that there are several must-haves that investors are going to be looking for. We’ve broken down the critical pieces of information that you would absolutely want to have accounted for in your pitch deck. While it's possible to have a variation of this pitch deck template this is generally considered the very least you'll want to include.

Title Slide

Your Company Name

Tagline

Problem Slide

What problem do your target customers face that your product/service solves?

Why now? In other words, how do the problems customers face and the trends that are happening in your market come together to create the perfect environment for your company to succeed?

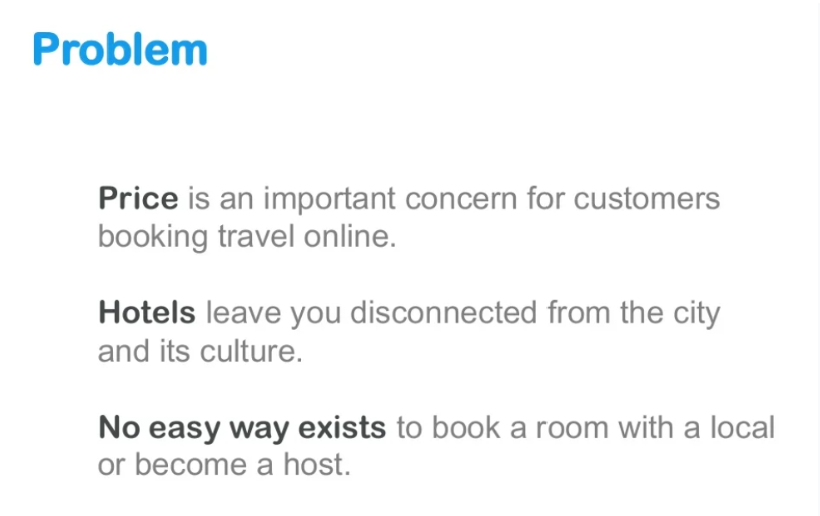

Airbnb Pitch Deck Example

Airbnb is able to explain the problem with just a few key points using the same pitch deck template of presenting the problem very simply.

Solution

How does your Solution solve the Problem outlined beautifully?

What makes your solution different from other options out there?

Why should potential investors care about this solution?

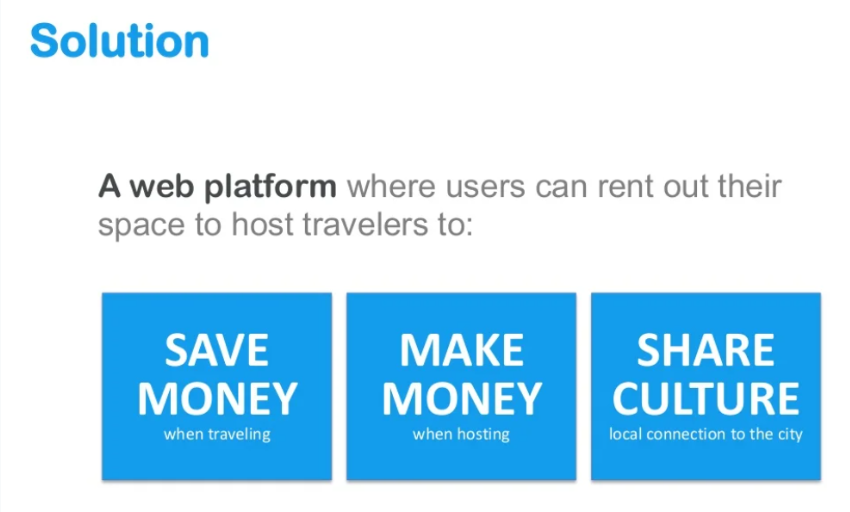

Airbnb Pitch Deck Example

Market SIZE

Focus on quick statistics and compelling case examples that paint a clear picture of the opportunity that exists for your company to succeed in your market.

How many people are there looking for a solution to this problem?

How much money are people spending in this space?

Why Now?

Explain how market forces are converging on this opportunity right now

Create some Fear of Missing Out (FOMO) for investors

Competition

Highlight the other companies working in your space, and how you stack up.

What are your competitors’ strengths? What do you plan to do to neutralize those strengths?

What are your competitors’ weaknesses? How do they translate into an advantage for your company?

Product

How does the product work? What's the special recipe?

What benefit does the customer achieve in the end?

What is in store for the future of the product (roadmap)

Business Model / Revenue Model

How do/will you make money? Who do/will you make money from?

How does your pricing compare with similar products in the market?

Have you generated any revenue to date? How much?

How much revenue do you expect to generate in the next five years?

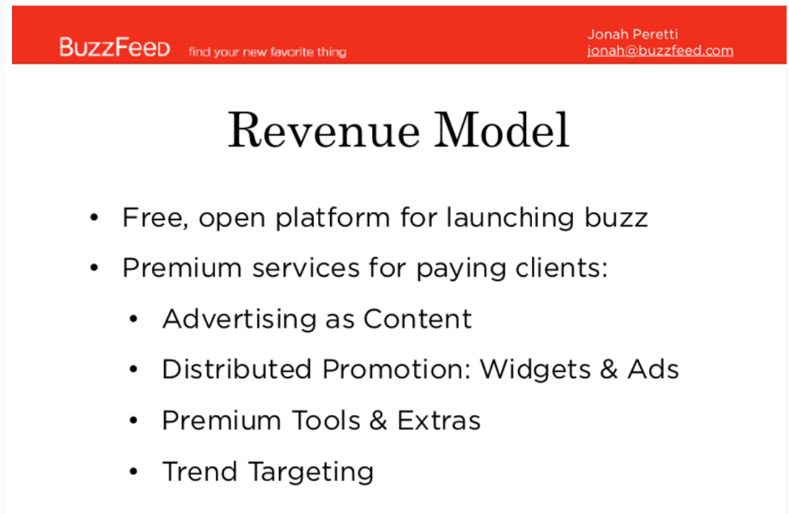

Buzzfeed Pitch Deck — Revenue Model Example

Revenue Models and Business Models go hand-in-hand in pitch decks and of course, investors want to know how a business is going to make money. It doesn't need to be complicated! Look at how the Buzzfeed pitch deck addresses this in just a few bullet points:

Traction

Highlight 3-4 key milestones that you’ve achieved so far.

Small milestones matter! It's the growth rate investors will focus on.

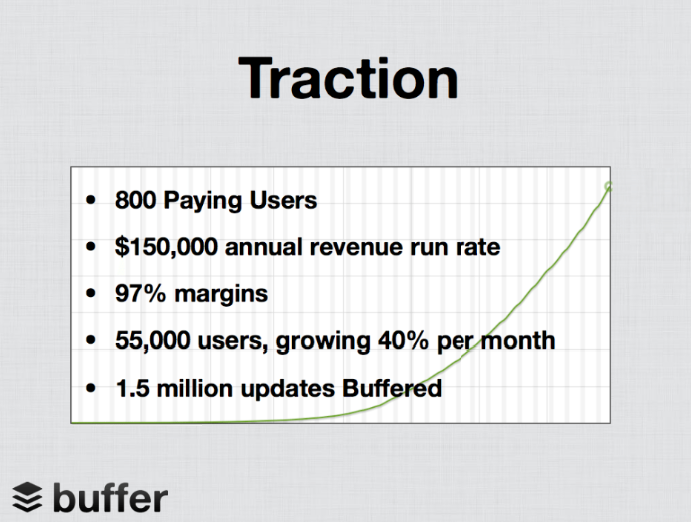

Buffer Pitch Deck Example

The Buffer pitch deck didn't have a ton of traction at the time as an online service, but they showcased growth metrics that would help make them a bigger global business.

Team

Introduce your key team members and highlight 2-3 things that make them a great asset to your team and the success of the company.

The team slide doesn't need to showcase the entire company structure — it's not a company directory!

The Ask

Funding Goal: How much money do you need to move forward with your goals?

Terms: What will investors get in exchange for their investment?

Milestones: What major milestones will the funding enable you to reach?

Intercom Pitch Deck Example

Intercom lays out its terms in the pitch deck ($500k convertible note) but more importantly explains how its capital will drive specific milestones (such as getting to annual recurring revenue).

More Slides? Maybe

Each pitch deck will have a few more slides that need to worked into the presentation to fit the needs of a specific startup. There's no hard and fast limit, although once we get over 12 slides we're often trying to pare down the number so that it's easier to digest.

Use your best judgment here, but always gravitate toward a startup pitch deck that's leaner. Remember that potential investors see a ton of pitch decks which means we have a very small window to make an impression. A long, lengthy pitch deck is more likely to put an investor to sleep than to convince them to invest!

Executive Summary

Sitting between your elevator pitch and a full-blown business plan is the executive summary. An executive summary is a more robust sales pitch for your business, distilling each key area of your business down into a paragraph or two to convey your business quickly.

The point of your executive summary, as the name implies, is to briefly summarize your business plan into just a few pages. Make no mistake though, it’s effectively the sales pitch for your business. Not only are you communicating the mechanics of the business, but you are also selling the value of your idea.

Two Approaches to the Executive Summary

There are two general ways of thinking about writing an executive summary. The first is to take your full business plan and distill it down into a few paragraphs about each key point. This makes sense and is easily done — assuming you have a full business plan written. The problem is, that many startup founders do not have a full business plan nor do they intend to write one.

The second way to approach writing an executive summary is to look at the key sections of what would be in a business plan and write the key points for each one of those (Management Team, Marketing Guide, Financials, etc.). This would mirror the work you've likely already done in your pitch deck so this may save some time.

However you choose to write your executive summary, it is a key asset to have on hand for investors to get a more detailed idea on your business.

Business Plan

It may seem as though entrepreneurs must prepare a business plan before approaching investors, but in reality, few do.

There are a few reasons for this. First, authoring a 50-page manifesto on how your future business will operate is typically the domain of MBAs and academics, and entrepreneurs rarely have the time, resources, or desire to dive into a project of that scope when they just want to get their business launched.

The second is that it’s an incredibly time-consuming process if you really want to dig into every step of a business plan from start to finish. That said, it’s also an invaluable exercise.

The Real Value of a Business Plan

The real value of a business plan isn’t in the actual document itself — it’s unlikely anyone will ever read it. The value comes from the planning, brainstorming, and research that goes into crafting the plan. The result of this effort makes your assault on your new business idea far more credible.

If you decide to build your entire business plan, you’ll certainly want to have it handy, but make sure if you’re introducing yourself to investors you start with more digestible documents like an executive summary or pitch deck. This is a nice teaser that will prompt a request for a business plan if you’ve piqued their interest.

Financial Documents

There are a couple of essential financial documents you will be asked to produce, provided your pitch is going well so far. After all, the point of investing in your company is to gain a return. Investors want to have an idea of what this return can be, and at what time.

The complexity of these documents varies. It is becoming harder and harder to project financials as things move more quickly – especially for scalable tech companies. They can vary from a one-page spreadsheet to a complex document of macros and changing outcomes. If everything is going well, you're going to be asked for your Financial Documents. The Financials cover a few aspects of your business from your Revenue Forecasts to your Operational Expenses to your Cash Flow.

The complexity of these documents can range from a single slide in your Pitch Deck showing some baseline guesses on where revenues will come from to highly complicated Excel Docs that involve macros and formulas changing outcomes based on key assumptions and scenarios.

Pro Tip from Mark Suster of Upfront Ventures

Mark Suster advises a monthly projection for the first 24 months, followed by annual projections for the “out years” – years 3-5.

“When I talk about a business plan I’m not talking about a 40-page Word document outlining your market approach. That died with waterfall software development. I’m not even talking about your 12-page Powerpoint presentation that you need to raise venture capital or to talk with potential biz dev partners. I’m talking about your financial spreadsheet.”

Mark Suster

Investor / Upfront Ventures

For general purposes, you'll need to cover at least a few aspects of your financial picture.

Revenue Projections. You'll need to explain where your revenue is going to come from, and within what periods. A four-year Revenue Projection is a good place to start. Mind you no one really knows exactly how much revenue is going to get generated for years to come, so this is more an exercise of what's possible, not what's guaranteed.

Operational Expenses. As the company grows, it's critical to point out where your expenses will grow accordingly. This is where you will explain how staffing, product costs, marketing, and overhead (rent, supplies) will scale with the growth of your business.

Cash Flow. The value of this information tends to vary with the type of business. Seasonal businesses, for example, will have particular cash flow concerns when they are heavy on cash in one period and light on cash in another. Similar to your Revenue and Operational Expense projections, your Cash Flow should detail exactly when you expect cash to come in and out of the business.

You may be asked for additional information such as a Balance Sheet, Pro-Forma Income Statement (a fancy word to mean "projected" revenue and expenses), and such. As long as you're communicating the three main tenets of the business — revenue, expenses, and cash flow — you should be in good shape here.

Company Collateral

A website is not critical for all businesses, and therefore may not be one of your key pitch assets. However, it is highly recommended to at least create a sort of landing page for your business telling people how they can instead reach you or find out more.

Start with a Web Site

Think of your website as sort of an e-brochure for your business, giving some visuals or just outlining your idea. As you grow your business, it’s a great way to provide validation, gain traction, and even gather contact information for potential customers.

Your pitch assets tend to be things you’ll either print or attach to an email. What the website provides is a reference point that provides supporting information for people who are interested in learning more after hearing your pitch.

You don’t have to put your company’s financial forecasts or secret sauce on your website. You can save that information for more personal communications.

Professional First Impression

The website should serve as a virtual brochure for your company. That could include screenshots of your product, a short explanation of what you’re setting out to do, a personal blog discussing your thoughts on the industry, etc.

What’s important about the website is that it gives people a professional view of your company, along with a taste of who you are and what you’re trying to accomplish. Your website is a convenient destination for anyone — both investors and consumers — who want to know more about your company. Plus, it’s much easier to direct people to your website than to a document.

The important mission for your website is to provide a professional-looking brand for your business for legitimacy, giving someone a view of who you are and what you do.

Summary

In thinking about the most effective way to approach your pitch, you’ve probably asked yourself, “How do I know what specific elements of my business investors want to hear about to determine if it has potential?”

We’ve devoted this phase to show you that it doesn’t require being a mind reader to nail the essential criteria every investor looks for (and expects) regardless of how you pitch them your story — whether via elevator pitch, your pitch deck, or business plan.

While we deconstructed the 10 key sections that go into longer form pitch presentations, the most important thing to take away here is that at its core, every great startup pitch revolves around a tremendously refined summary of your problem, solution, and market size.

We learned that the problem is the foundation on which your entire concept is built and that creating a compelling, relatable story around the biggest problem you solve is crucial to making your solution all the more impactful when you explain how it ties back directly to that problem.

We also understand that connecting your problem to the biggest possible addressable audience, or your total addressable market, is absolutely key in showing investors that the market your operating in is worth getting excited about (and signing a check over!)

Continue to Part 9 - Traction

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.

No comments yet.

Start a Membership to join the discussion.

Already a member? Login