The Startups Team

A crypto startup is a business that deals with cryptocurrencies. Startups focused on this industry have been popping up all over the world in recent years. With the rise of Bitcoin, Ethereum, and other cryptocurrencies, many entrepreneurs are looking to create their own crypto or blockchain-based startup.

It sounds easy enough in theory, but for those new to the industry, it's much like learning another language. In this article, we aim to define, expand on, and share insights we have compiled to demystify the process of launching a crypto startup.

There are five main steps to starting a crypto startup (we'll expand more on this below):

1. Identify a problem that needs solving.

2. Create a white paper outlining the idea (i.e. a solution to the problem) and how it will work.

3. Find or create a team of developers to build the platform.

4. Raise money through an ICO (Initial Coin Offering) or VC funding.

5. Develop the company and buy/sell tokens (hooray!)

Understanding Crypto Networks and Why They Matter.

We'll keep this part pretty high level, there are plenty of articles that deep dive into crypto networks, blockchain and its various applications, its history, progression, and definition.

The definition by analogy that I like the best is one that I heard Chris Dixon (a general partner at Andreessen Horowitz) use:

Blockchain is like a virtual computer that runs on top of a network of physical computers that provides strong, auditable, game-theoretic guarantees that the code it runs will continue to operate as expected.

Let's illustrate that definition for some clarity. For example, Ethereum is blockchain technology, and for programmers, can be thought of as a single instance of a virtual computer, where they may be using Solidity (a programming language) to build a payment channel.

So, why would they want to use Ethereum and Solidity to do this, as opposed to any other programming language on a virtual machine running on a cloud service like AWS for example? Well, it's the latter part of that definition that becomes important. The physical network of computers that the blockchain exists across (miners, validators) ensures that the code you've written will always operate as intended — giving you a high degree of certainty in the stability and immutability of your code and the data it handles.

Further, in applications that require a high degree of trust, where trust may otherwise not exist this becomes really important. For example, financial transactions between two parties for digital assets (the code base of a cool new crypto startup let's say) can rely on the immutability of smart contracts to force security on both sides.

In the case of any NON-blockchain computer, like a physical computer, or a traditional virtual machine (boy, that feels strange to say), where you have a single physical space (in the case of the computer) or you're paying to use space on a virtual computer (like AWS, or even Dropbox), someone owns the right to change the rules. This means that you can't guarantee that the code, the application that the code drives, or the data that the application manages, will always run as expected, or that aspects of it won't be changed, lost, etc.

Ask anyone who's run a WordPress site and missed an update that caused a plug-in to malfunction — they may not know it, but inherently, at that moment, they understood the value the blockchain would have represented.

The Basics of Blockchain Technology.

Blockchain technology is an emerging technology that has the potential to change the world (and quite possibly, already has).

The Blockchain is a distributed database that stores transaction records. It is the backbone of any cryptocurrency, and without it, digital currencies wouldn’t exist. It is a new way of organizing information and the way we interact with it.

All crypto assets run through blockchain technology distributed systems, creating somewhat of a digital wallet that continues allowing users to buy, trade, and sell multiple types of coins on the cryptocurrency market.

How Blockchain Technology is Being Applied Now

Blockchain technology is a digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value. Blockchain platforms or distributed ledgers are best known as the backbone of Bitcoin and other cryptocurrencies, where they serve as public transaction records.

Anyone serious about starting a crypto startup should do research on how their idea can utilize and grow with blockchain technology.

Launching and Growing Crypto Startups

Crypto projects are "simple" enough to launch, but difficult to grow. First, it's important to understand how the world of crypto even works and how it applies to life as we know it. We've covered some of that in this article already and plan on diving in deeper moving forward.

Much like every other startup (whether in the crypto space or not), crypto startups have to have purpose beyond a general interest in the industry or wanted to hop on a trend with delusions of grandeur. If a business doesn't have purpose, there is no viable reason to build it in the first place.

This purpose should be big enough to keep you and the team moving forward. If it isn't, you need another purpose! If it is, growing your startup will be a lot of hustle and networking. Creating relationships with fellow founders in the industry (especially those that have been through it all before) will ideally help your startup scale faster by utilizing the given advice. This is not the time to play a guessing game.

Founders that are serious about growing their crypto projects should make connections with experts in that field and ask as many questions as possible to avoid potential downfall.

The Economics of Crypto

The economics of crypto is an interesting field to study. It is not only about the coins, but also about the people who are involved in this new market.

There are many ways in which one can make money with crypto and the best way is to find out what you love doing and then do it for crypto. For example, if you love writing, you can write articles or blog posts for some websites that pay in cryptocurrency. If you are good at designing stuff then you could design logos or banners for different companies that offer their services in cryptocurrency.

Not only does the blockchain platform offer multiple job opportunities within the industry, but actually creating crypto assets as a product to sell to consumers (ie a Crypto Startup) is at the top of everyone's mind when the term "crypto" is mentioned directly or in passing.

The following is a list of the most popular cryptocurrencies.

Ethereum (ETH) - Ethereum is a public, open-source blockchain-based distributed computing platform featuring smart contract functionality.

Bitcoin (BTC) - Bitcoin is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator.

Ripple (XRP) - Ripple was created to enable global payments for businesses and consumers to be processed faster and more efficiently than ever before.

Litecoin (LTC) - Litecoin was created as an alternative to bitcoin and has since become one of the world's most used cryptocurrencies with its unique features that provide rapid transaction confirmation times, improved storage efficiency, and lower transaction fees than bitcoin.

Should You Decentralize? (hint: yes! so, how?)

Most anyone who has been on the internet in the last few years (or longer) has felt deceived by a tech platform at one time or another — and that's an understatement. Think of Facebook and Google and how much information they know about you, for example.

Decentralization turns control of platforms over to users, in a matter of speaking.

"The core innovation of decentralized cryptocurrencies is their capacity to mitigate risks through technology." — The Cato Institute's Jack Solowey and Jennifer J. Schulp

But one decentralization isn't equal to the other. Decentralization will only help token projects stay on the right side of the law if that decentralization is genuine. In order to protect your users, don't take this step lightly. We highly recommend hiring an attorney versed in blockchain technology to make sure all your odds and ends are covered.

Keeping it Together, When You're all Apart.

As the founder, you're more than likely the chief executive officer of your company as well (at least in the formative years). This means that you are the captain of the ship, the head of the household, and the one that everyone turns to with issues, errors, and other obstacles the startup may face.

Chances are you don't have a computer science degree and might not have all the relevant information to take the sword and ride into battle on your own (what, you're not fluent in cryptography? Scoff!), and this means you will need a dependable team with you to manage the work that is out of your scope of expertise.

Creating Value in Crypto Startups

In order to create value, it is important to identify the core problem that the startup is solving. We can't iterate this enough!

There are currently many different crypto startups that are creating their own cryptocurrencies and blockchain networks. These startups are trying to solve different problems such as providing privacy, security, and decentralization.

The most successful crypto startups have a great team behind them that understands the technology they are working with and can communicate it effectively to their users.

Getting Developers Behind Your Crypto Startup

Developers are the key to any project. They are well versed in cryptography (the art of writing or solving codes) and that's exactly what every crypto startup needs. If you want your idea to be successful, you need to get developers on board.

This is a tough task when you consider that there are many other startups that want the same thing. Crypto startups need to get developers on their team, but they often don’t know how.

There are many ways that a crypto startup can go about this. One way is to look for developers on freelance sites such as Upwork or Freelancer.com and offer them a position at the company. Another way is to find developers who are interested in the project and offer them equity in the company instead of a salary.

Here are some other tips on how to recruit developers for your project:

1. Offer competitive salaries and benefits

Developers should be able to make a good living for themselves as well as provide for their families.

2. Offer challenging work

Developers need stimulating work that will keep them engaged and interested in their projects. If they feel like they're just churning out code in a monotonous way, then they'll eventually lose interest in the project and leave it behind.

3. Provide opportunities for growth

Much like any other member of a startup, developers want opportunities to grow in their position.

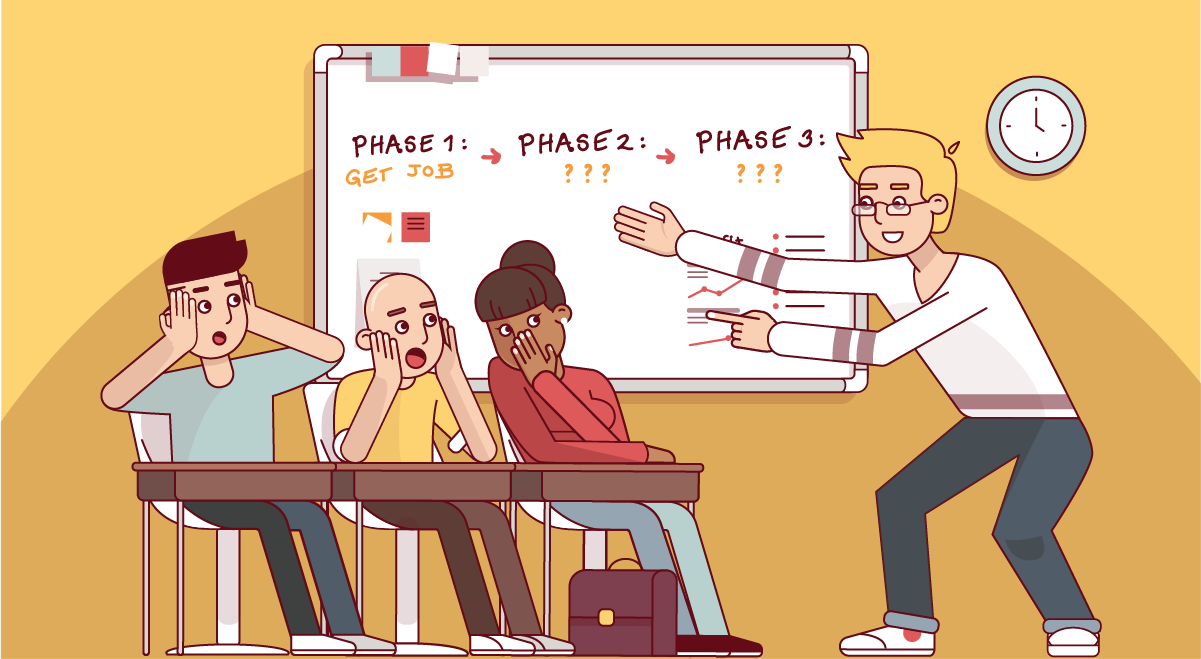

The 3 Ps of Crypto Development: From Problem to Protocol to Product.

Cryptocurrency development is a complex process that starts with identifying a need and ends with a working product. The first step is defining a problem that needs to be solved and then finding an appropriate protocol — which is the set of rules that govern the operation of the cryptocurrency.

Once the protocol has been identified, it is time to build a working prototype or MVP (minimum viable product) that can be tested with potential users in order to refine it before launching it as a final product.

Crypto Startup Security

Cryptocurrency was once targeted to a niche audience and was seen as a notional investment, but interest in crypto and other blockchain-powered innovations (much like non-fungible tokens and smart contracts) has hit the mainstream.

Entrepreneurs who are capitalizing on this industry are creating exchanges rapidly and frequently without proper consideration of security measures. When a crypto exchange is hacked, the losses can be devastating. But lucky for budding founders ready to embark on the crypto journey, blockchain technology can be nearly impossible to hack if set up properly.

"The primary benefit of using blockchain technology is that it ensures security in transactions due to its principles of cryptography, decentralization, and consensus." — IBM

However, blockchain networks are not immune to cyberattacks and fraud. Hackers with ill intent can manipulate discovered vulnerabilities in the blockchain infrastructure and have previously succeeded in various hacks and frauds. This opens the door of possibility that malpractice can happen again and increases the urgency for all crypto startups to ensure their security systems are all in place, and up to date.

Regulators, Mount Up (security best practices)

When designing a blockchain solution, consider these key points:

1. What is the governance model for participating members or organizations?

2. What specific data will be captured in each block?

3. Define the regulatory requirements, and what is needed to meet them.

4. How are the identity details managed? How are keys managed and revoked? Are the block payloads encrypted?

5. What is the disaster recovery protocol for the blockchain participants?

6. What is the minimal security posture for blockchain clients (for participation)?

7. Identify the logic for resolving blockchain block collisions.

Raising Funds for Crypto Startups

So you're looking for some coin to get your crypto startup off the ground? Let's dive into how to raise funds for your business.

Not too long ago, cryptocurrency was the next big trend, not taken seriously by investors, a whisper of buzzwords and hype, raising more questions than funding. But through the last decade or so, things have drastically changed and some financial institutions are only focusing on the cryptocurrency space, attempting to capitalize on the opportunity.

Banks are backing more loans, and investors are excited about getting in at the ground level of new and innovative ideas. If you happen to have an idea that solves for a major pain in the crypto industries, you will have a better fortune finding financial backing for your startup.

ICO (Initial Coin Offering)

An initial coin offering (ICO) is a fundraising mechanism for companies to raise funds for their projects. It is similar to an Initial Public Offering (IPO) in which investors purchase shares of the company.

The first ICO was held by Mastercoin back in 2013. Ethereum raised money with an ICO in 2014 and it became the first open-source blockchain project to hold one. Since then, it has become a preferred method of fundraising for crypto startups. In an ICO, the company issues tokens that can be purchased with other cryptocurrencies or fiat currencies like US dollars.

These ICOs are also called "token sales" or "crowd sales," and they are usually done through a blockchain-based system that can be accessed by anyone with an internet connection. New projects looking for funding can sell their underlying crypto tokens in exchange for cryptocurrency. The ICO process has many benefits over traditional fundraising methods, such as not needing to pay fees to banks or venture capitalists, and not having to give up equity in the company.

The first step in launching an ICO involves creating a white paper that describes the problem, solution, and details about the coins being offered. If this document does not exist for a particular token, then it must be created before continuing with other steps.

Investors can purchase tokens using popular cryptocurrencies like Bitcoin and Ether at different stages of the project's development. These tokens are not just used as currency; they also provide access to services. The ICO typically takes place before the token or coin has been fully developed and released, so investors will often not receive anything other than their tokens or coins until after it has been built and released to the public.

So, you still want to start a crypto business?

This is advice that you could apply to start any startup — but it's especially important in emerging spaces — MAKE SURE YOU ARE FOCUSED ON SOLVING AN ACTUAL PROBLEM. Yes, that was all caps as in "I'm shouting"— because I need to make sure you heard me.

Far too many startups, and a disproportionate number of those in the blockchain technology/crypto startup space have been (largely accurately) accused of being solutions running around looking for problems. It's a bad look. It's never going to be in style. Avoid it at all costs.

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.

Start a Membership to join the discussion.

Already a member? Login

Starting a crypto startup can be an exciting venture, but it requires careful planning and execution due to the complexities and rapidly evolving nature of the cryptocurrency industry.